ct sales tax online

We cover more than 300 local jurisdictions. Log in or Register for the first time below to subscribe to e-alerts or to update your subscription profile.

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

The statewide rate of 635 applies to.

. Local Sales Tax Range. Visit our Electronic Filing Page to file Business or Individual returns. Start filing your tax return.

Base State Sales Tax Rate. The New State Tax Portal Is Now Live. Individual Income Tax Attorney Occupational Tax.

Individual Income Tax Attorney Occupational Tax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. A cloud-based solution to file and remit tax returns.

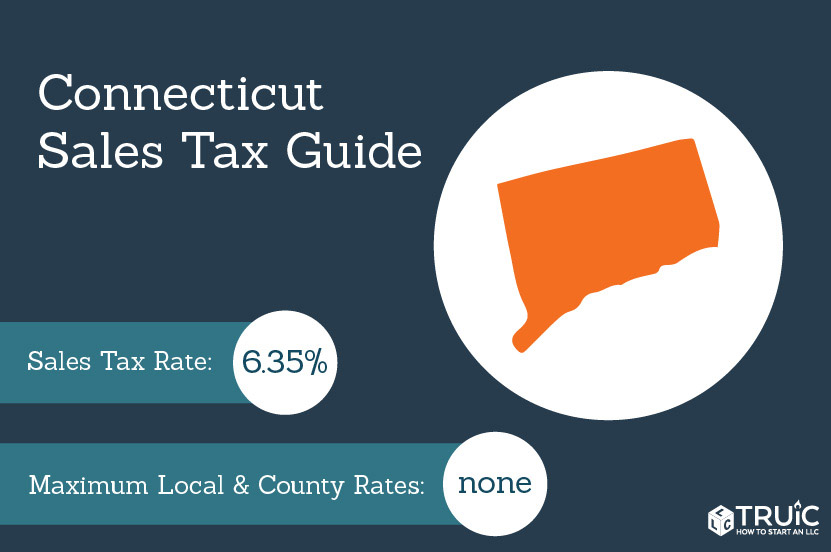

Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. Sales Tax Rates There is only one statewide sales and use tax. No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in.

Create a Tax Preparer Account. 635 2022 Connecticut state sales tax Exact tax amount may vary for different items The Connecticut state sales tax rate is 635 and. You can process your required sales tax filings and payments online using the official Connecticut Taxpayer Service Center website which can be found here.

Now you can file tax returns make payments and view your filing history in one. Sales tax is charged at a rate of 775 for any vehicle registered as passenger or combination when the total cost of the vehicle more than 50000. There are no additional sales taxes imposed by local jurisdictions in Connecticut.

Combined Sales Tax Range. Our free online Connecticut sales tax calculator calculates exact sales tax by state county city or ZIP code. The current state sales tax rate in Connecticut CT is 635.

800 524-1620 Sales Tax Application Organization. Is the new online hub for business tax needs. Connecticut requires out-of-state merchants to collect and remit sales tax if they make at least 200 transactions per year involving Connecticut residents and have at least.

Sales Tax Returns Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. There are no local sales tax rates which means that collecting sales tax is easy. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and.

If your vehicle was purchased from a licensed dealership the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price. What is the 2022 Connecticut Sales Tax Rate. Returning Users Login Business Account For business owners or companies who need to file for a single business or a business with.

We allow full trade-in credit when. Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. When any of the below taxable items are.

Home - Connecticut Tax Sales.

Reminder Connecticut S Sales Tax Free Week Runs Through Saturday

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/RA6ZM3IVZZA6NPHNBDESBC4E2E.jpg)

Candidates For Governor Agree Connecticut Online Shoppers Should Pay Sales Tax Hartford Courant

Form Os 114 Fill Out Sign Online Dochub

The Nutmeg Collective Ct Sales And Use Permit

Stop The Cap Supreme Court Decides In 5 4 Decision States Can Impose Sales Tax On All Online Purchases

How To File And Pay Sales Tax In Connecticut Taxvalet

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Ct Never Came Up With A Plan To Collect More Online Sales Tax

Connecticut Department Of Revenue Services

Free Online Tax Filing E File Tax Prep H R Block

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Register For A Sales Tax Permit Taxjar

Ct Sales Tax Chart Fill Out Sign Online Dochub

Internet Sales Tax Collections To Increase Dec 1 Ct News Junkie

How To File And Pay Sales Tax In Connecticut Taxvalet

Connecticut Department Of Revenue Services

Fillable Online Cultureandtourism Au 677 Declaration Of Payment Of Connecticut Sales And Ct Gov Cultureandtourism Fax Email Print Pdffiller